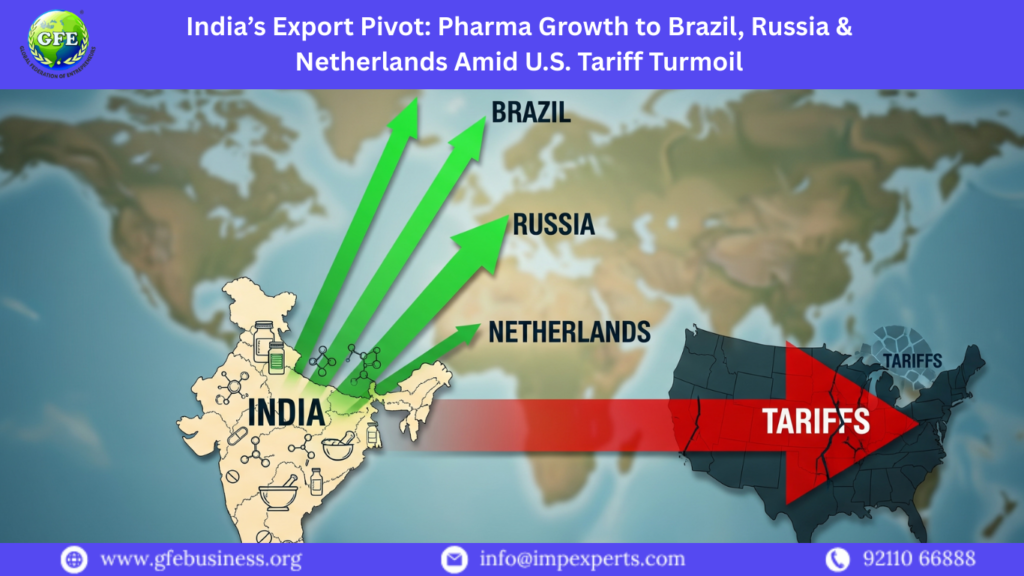

If you are an entrepreneur, startup owner, or aspiring exporter looking to enter the pharmaceutical export market, understanding international trade dynamics is essential. India’s pharma sector has been a global leader in generic medicines, APIs, and vaccines. However, with U.S. tariffs and regulatory challenges creating uncertainty, businesses are now pivoting towards new opportunities in Brazil, Russia, and the Netherlands.

Many businesses rely on platforms like GFE Business to gain practical insights, understand compliance requirements, and develop strategies to navigate complex international markets. In this guide, we will explore how India’s pharma export landscape is evolving, the opportunities in these new markets, challenges exporters may face, and strategies to thrive globally.

Understanding India’s Pharma Export Landscape

India is the world’s largest supplier of generic medicines, exporting to over 200 countries. Pharmaceuticals are one of India’s top export commodities, contributing significantly to the country’s foreign exchange earnings. The sector has historically relied heavily on the U.S. market due to its high demand for generic medicines. However, recent U.S. tariff measures and regulatory bottlenecks have emphasized the need for market diversification.

Key Export Figures:

India accounts for nearly 20% of global generic medicine supply.

Annual pharmaceutical exports are valued at over $20 billion, with consistent growth year-on-year.

India supplies essential medicines, vaccines, and APIs to over 150 developing countries, fulfilling global health needs.

Exporters who adapt to these changing dynamics by exploring new markets can safeguard revenue and grow sustainably. Platforms like GFE Business provide detailed training on international trade compliance, market research, and global business strategy.

Why Brazil is Emerging as a Key Pharma Market

Brazil, the largest economy in Latin America, has seen rapid growth in its healthcare and pharmaceutical sector. The government has implemented policies to expand access to medicines and healthcare services, increasing demand for generics and cost-effective drugs.

Opportunities in Brazil:

Generics Market Growth – Indian pharma firms are well-positioned to supply affordable generic medicines.

Vaccine and API Demand – Brazil requires a stable supply of vaccines and raw materials for domestic production.

Trade Incentives – India has strengthened trade agreements with Brazil, facilitating easier market entry.

Challenges:

Regulatory approvals can be time-consuming and require thorough documentation.

Language barriers and local business practices may require partnerships with domestic distributors.

Logistics and transportation costs are significant considerations.

By strategically entering Brazil, Indian exporters can establish a foothold in Latin America, expanding their global reach while mitigating risks associated with the U.S. market.

Russia: A Strategic Export Destination

India and Russia share long-standing trade relations, particularly in the pharmaceutical sector. Recent geopolitical shifts and sanctions on Western countries have increased Russia’s reliance on Indian medicines, especially generics and essential drugs.

Key Advantages:

Rising Demand – Russia’s healthcare system is increasingly dependent on imports for critical medicines.

Government Collaboration – Bilateral trade agreements favor Indian exporters, making market entry smoother.

Cost-Effective Supply – Indian pharma products are priced competitively, appealing to Russian buyers.

Challenges:

Currency fluctuations and payment mechanisms can impact profitability.

Exporters must navigate Russian regulatory approvals, including certifications and quality standards.

Political and economic factors may introduce additional risks.

Successful exporters, like Dr. Reddy’s and Sun Pharma, have leveraged these opportunities by establishing partnerships with local distributors and aligning their products with Russia’s healthcare requirements.

The Netherlands: India’s Gateway to Europe

The Netherlands serves as a strategic hub for Indian pharma exports to Europe. Its advanced logistics infrastructure, including the ports of Rotterdam and Schiphol Airport, allows for efficient distribution across the EU.

Benefits of Exporting via the Netherlands:

EU Market Access – Exporting to the Netherlands provides a gateway to over 27 European countries.

Advanced Logistics – Efficient shipping, warehousing, and distribution networks streamline exports.

Compliance and Standards – Many Indian pharma companies already meet EU regulatory standards, easing entry into European markets.

Focus Areas:

Generics and biosimilars

Specialty drugs and vaccines

Biotech collaborations

Although EU regulations are stringent, the Netherlands offers Indian exporters an opportunity to establish a long-term presence in one of the world’s most lucrative pharmaceutical markets.

Challenges in Diversifying Pharma Exports

While expanding to Brazil, Russia, and the Netherlands provides growth opportunities, Indian exporters face several challenges:

Regulatory Compliance – Each country has unique laws, certifications, and documentation requirements.

Logistics and Transportation – High shipping costs, customs procedures, and delivery timelines must be carefully managed.

Market Competition – Indian exporters compete with European, Chinese, and local pharma companies.

Financial Risks – Currency fluctuations, delayed payments, and trade finance challenges can impact profits.

Structured guidance and professional training, like those offered by GFE Business, help businesses navigate these challenges successfully.

Strategies to Succeed in New Export Markets

Conduct Market Research

Understand product demand, competitor pricing, and regulatory requirements. Platforms like GFE Business provide insights into market entry strategies.Start Small and Scale

Begin with smaller shipments to test the market, gain experience, and adjust operations based on local demand.Build Local Partnerships

Collaborate with distributors, agents, or joint venture partners to navigate language, culture, and compliance requirements effectively.Leverage Technology

Use e-commerce platforms, CRM systems, and digital marketing to reach buyers efficiently across international markets.Secure Trade Finance and Insurance

Use tools such as Letters of Credit (LC), bank guarantees, and insurance policies to mitigate financial risks.

Government and Institutional Support

The Indian government supports pharmaceutical exporters through:

Foreign Trade Policy (FTP) – Provides export incentives and duty exemptions.

Export Promotion Councils – Industry-specific guidance and market intelligence.

EXIM Bank of India – Trade financing, buyer’s credit, and working capital support.

Trade Missions and Fairs – Opportunities to connect with global buyers.

Exporters who leverage these policies can reduce barriers, improve competitiveness, and expand confidently into new markets.

Case Studies: Indian Pharma Success Stories

1. Sun Pharma in Brazil

Sun Pharma expanded in Brazil through acquisitions and partnerships, establishing one of the largest Indian pharma footprints in Latin America.

2. Dr. Reddy’s in Russia

Dr. Reddy’s successfully navigated Russian regulations and supply chain challenges to become a trusted supplier of generic medicines.

3. Cipla in the Netherlands

Cipla leveraged the Netherlands’ logistics infrastructure to distribute products across Europe efficiently, ensuring compliance with EU standards.

These examples demonstrate that strategic planning, compliance knowledge, and partnerships are key to thriving in new export markets.

Opportunities for Indian Exporters and Startups

Emerging markets like Brazil, Russia, and the Netherlands present opportunities beyond revenue growth:

Diversification reduces dependence on the U.S. market

Access to high-demand regions with growing healthcare needs

Potential for long-term partnerships and supply chain integration

Skill and knowledge enhancement through export-import training

Professional guidance and structured training, such as that offered by GFE Business, prepares entrepreneurs to understand documentation, regulations, and global logistics challenges effectively.

Final Thoughts

India’s pharmaceutical sector is demonstrating resilience in the face of U.S. tariff uncertainties. By pivoting toward Brazil, Russia, and the Netherlands, Indian exporters are securing growth while reducing risk. For entrepreneurs and startups, this is a reminder that global trade success depends on market diversification, regulatory knowledge, and strategic partnerships.

For beginners and business owners, taking professional training and guidance from experts ensures a smooth, profitable, and sustainable entry into international trade.

Ready to expand your pharma exports globally? Visit GFE Business and gain expert-led training that prepares you for real-world international trade.